U.S.A. –-(AmmoLand.com)- On November 9, 2012, Cook County Illinois created a special tax on guns. On November 18, 2015, the County board added a tax on ammunition. At the time, this correspondent believed the tax to be unconstitutional on its face. So did the Illinois Advocacy Group for Second Amendment rights, Guns Save Lives. They filed a lawsuit, challenging the tax law, on December 17, 2015.

The lower courts in Illinois did not agree. They did not find a problem with the taxes. Guns Save Lives appealed to the Illinois Supreme Court. The case was decided on October 21, 2021. The decision was unanimous, 6-0. Chief Justice Anne M. Burke did not take part in the decision. The judges ruled the taxes to be unconstitutional, but the majority decision was a narrow ruling based on tax law instead of the Second Amendment or the Illinois State Constitution. From sj-r.com:

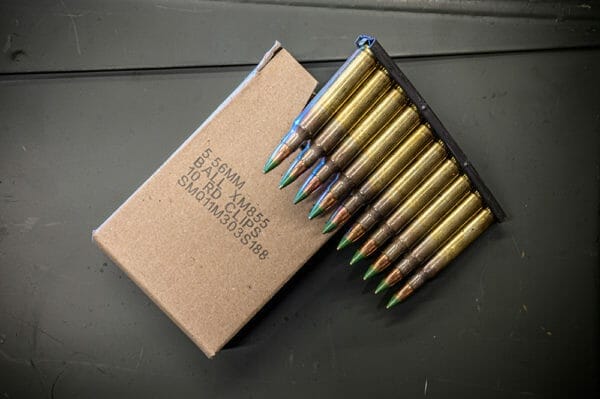

The Cook County gun tax, which took effect in April 2013, imposed a $25 fee for retail gun purchases in the county, as well as a 5 cent fee per cartridge of centerfire ammunition and 1 cent per cartridge fee for rimfire ammunition.

The taxes were challenged by the trade group Guns Save Life Inc. in a lawsuit against the county.

The Supreme Court’s Thursday opinion, written by Justice Mary Jane Theis, stated that, “While the taxes do not directly burden a law-abiding citizen’s right to use a firearm for self-defense, they do directly burden a law-abiding citizen’s right to acquire a firearm and the necessary ammunition for self-defense.”

The majority opinion held that under the Illinois Constitution, taxing power and regulatory power are separate. They held, under Illinois law, taxing is not regulation. Thus, the strong pre-emption statute passed in Illinois as part of the weapons law reforms required by the Seventh Circuit, did not apply to taxes. Then they found the tax did not conform to the requirements of the Illinois tax code, and thus, was unconstitutional, because it impacted a fundamental constitutional right.

Part of their decision is troubling. It accepts a fundamental error in the assumption about the nature of reality. Cook County asserts “gun violence results from guns”. From the decision:

Here, the entity responsible for justifying the tax, the County, maintains that the tax classification is justified since a reasonable relationship exists between the special tax and the object of the ordinances. The proffered justification for the taxes is to fund the staggering economic and social cost of gun violence in Cook County. The County asserts that firearms and ammunition are instruments of death and that their harmful effects cost the County immeasurably in terms of public health, safety, and welfare.

This is a straw man argument, because it only looks at guns, and only at the harm done with guns. It does not consider the positive uses of guns. Moreover, the inherent assumption is, if there were no guns, the harm would be eliminated or reduced. From the evidence, that is false. The harm would continue to be done, simply with other instruments, and plausibly would be greater than the harm done with guns. The majority of justices do not mention these facts. Instead, they accept the false premise:

In applying that standard to the firearm and ammunition taxes, we recognize that the uniformity clause was “not designed as a straitjacket” for the County (Arangold, 204 Ill. 2d at 153) and acknowledge the costs that gun violence imposes on society.

It is not clear the mere presence of guns imposes any net costs on society. The evidence indicates there are no net costs. Net benefits of the presence of firearms in society are likely.

Justice Michael J. Burke concurred with the rest of the justices in a special opinion. His opinion is particularly convincing. The argument is straightforward. The Illinois Constitution does not allow taxation of the right to keep and bear arms. From the decision:

Justice Michael J. Burke, specially concurring:

Moreover, the reason why those statutes preempt handgun regulations, not handgun taxes, is obvious—the Illinois Constitution only allows the legislature to preempt regulations, not taxes. And taxes that infringe the right to keep and bear arms are already precluded by the Illinois Constitution. See Ill. Const. 1970, art. I, § 22; id. art. VII, § 6. Moreover, even if the statutes mentioned by the County did intend to specifically preserve for home rule units the power to tax handguns in the manner under consideration here, that would not show that the framers of our constitution intended to authorize a home-rule unit’s discriminatory taxation of firearms, where the text of that constitution clearly prohibits taxation that infringes on the right to keep and bear arms.

In Illinois, the police power and the taxation power are separate. The Illinois Constitution only places a limitation of the right to arms subject to police power. From the Illinois Constitution:

SECTION 22. RIGHT TO ARMS Subject only to the police power, the right of the individual citizen to keep and bear arms shall not be infringed.

The amendment specifically forbids any other power being used to infringe on the right to arms.

The Illinois protection for the right to arms is not very strong. In the case of taxes, it appears to be strong enough.

About Dean Weingarten:

Dean Weingarten has been a peace officer, a military officer, was on the University of Wisconsin Pistol Team for four years, and was first certified to teach firearms safety in 1973. He taught the Arizona concealed carry course for fifteen years until the goal of Constitutional Carry was attained. He has degrees in meteorology and mining engineering, and retired from the Department of Defense after a 30 year career in Army Research, Development, Testing, and Evaluation.

from https://ift.tt/3qjFSwq

via IFTTT

No comments:

Post a Comment